Action Plan

We do not produce shelf plans. Our plans are only successful when they result in built projects. We guarantee significant change within 5 years of plan adoption.

The finish line for our projects is not the plan document. We provide plans that result in widespread public support and developer interest. We can attract latent market demand where none is often apparent. This requires a visionary yet realistic redevelopment plan and a common-sense implementation strategy.

While a Downtown Master Plan, TOD Station Area Plan, or District Redevelopment Plan may have a long-range 10-20-year strategy, we provide an emphasis on the actions necessary for immediate and substantial positive change within the first five years of plan adoption. Crandall Arambula's implementation strategies always include:

Catalyst and Priority Project Recommendations— initiated primarily by the public sector to facilitate private sector development. In some instances, implementation of these projects may need to be coordinated with the private development sector through Public-Private Partnerships (PPPs).

Timelines and Responsibilities Recommendations. Identification of responsible parties for each project and a critical path for their execution. Typically, we provide a timeline that should revisited by elected officials at regular benchmarks (180 days, annually, 5 years) with a report on progress.

Financing Strategies. Identification of the amount of necessary investment and sources.

Crandall Arambula subscribes to the belief that effective implementation strategies are defined as the identification of public actions that will produce a sustained and widespread private market reaction.

-Alexander Garvin “The American City: What Works, What Doesn’t”

‘Game-Changing’ Catalyst Projects

Crandall Arambula winnows the priority projects, to a concise short-list of ‘game-changing’ projects that will implemented within 5 years of plan adoption. Only priority projects that can positively address Crandall Arambula’s proprietary ‘recipe’ for Game-Changing Catalyst criteria are selected. A selected project must meet all of the following requirements:

Changes the public perception of the downtown, neighborhood, district, or station area creating or renewing a sense of community pride, and meets long-term vision, goals, and objectives.

Strategically located to spur immediate redevelopment momentum of adjacent underutilized and vacant sites. Moreover, catalyst projects should strengthen and complement existing desirable uses rather than conflicting or competing with these uses.

Attracts significant private sector investment interest because the development outcome is predictable and certain. That means the development proposal is consistent with local or regional real estate development best practices, barriers to redevelopment are removed or minimized, and financing strategies are in place to reduce financial risks for untested or innovative development types.

Maximize any required Public Investment Required to Draw Private Investment Interest.

“There has been an amazing

shift in activity … It is a wonderful

transformation.”

Devin Sutherland

Executive Director

Downtown Racine Corporation

Business Case

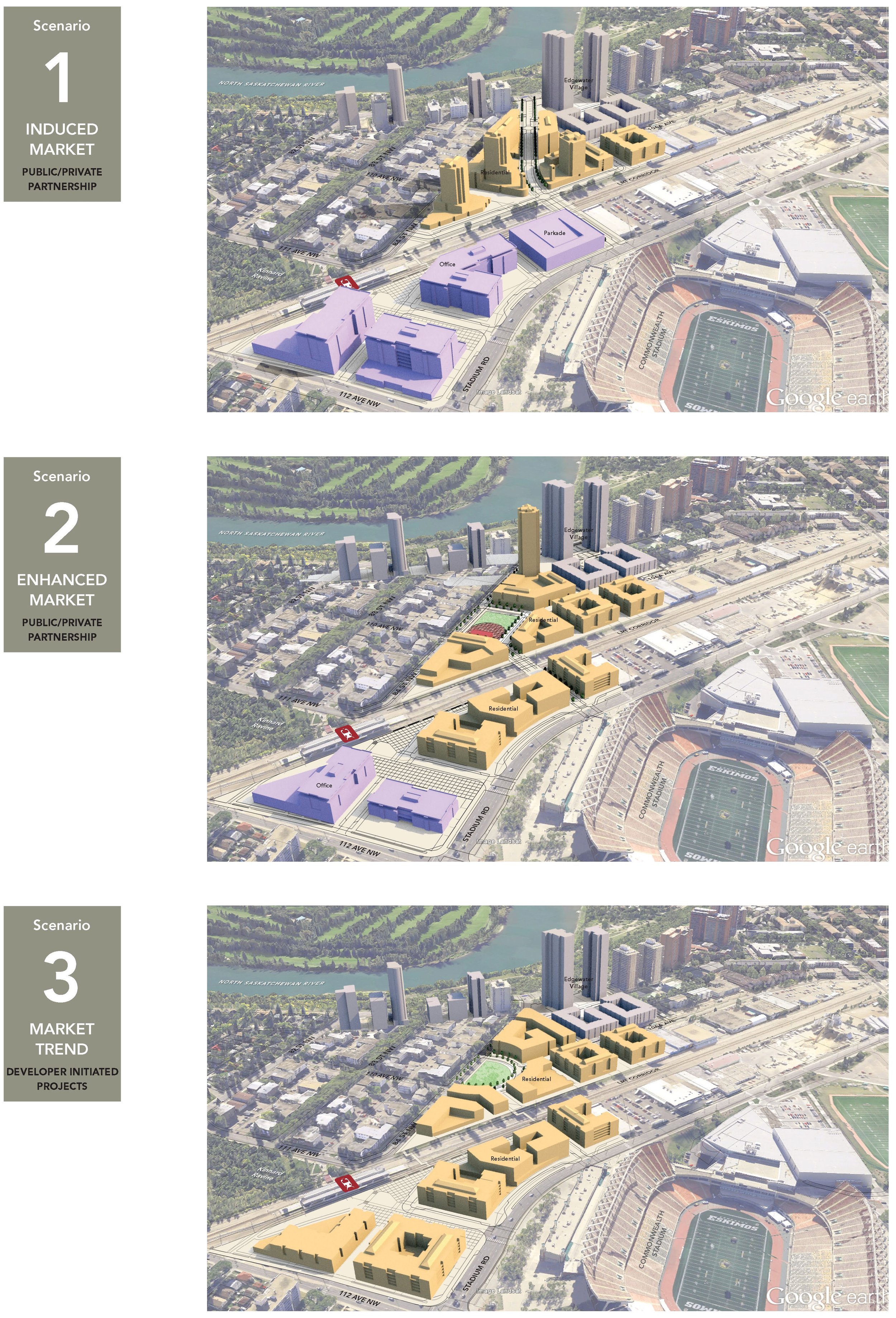

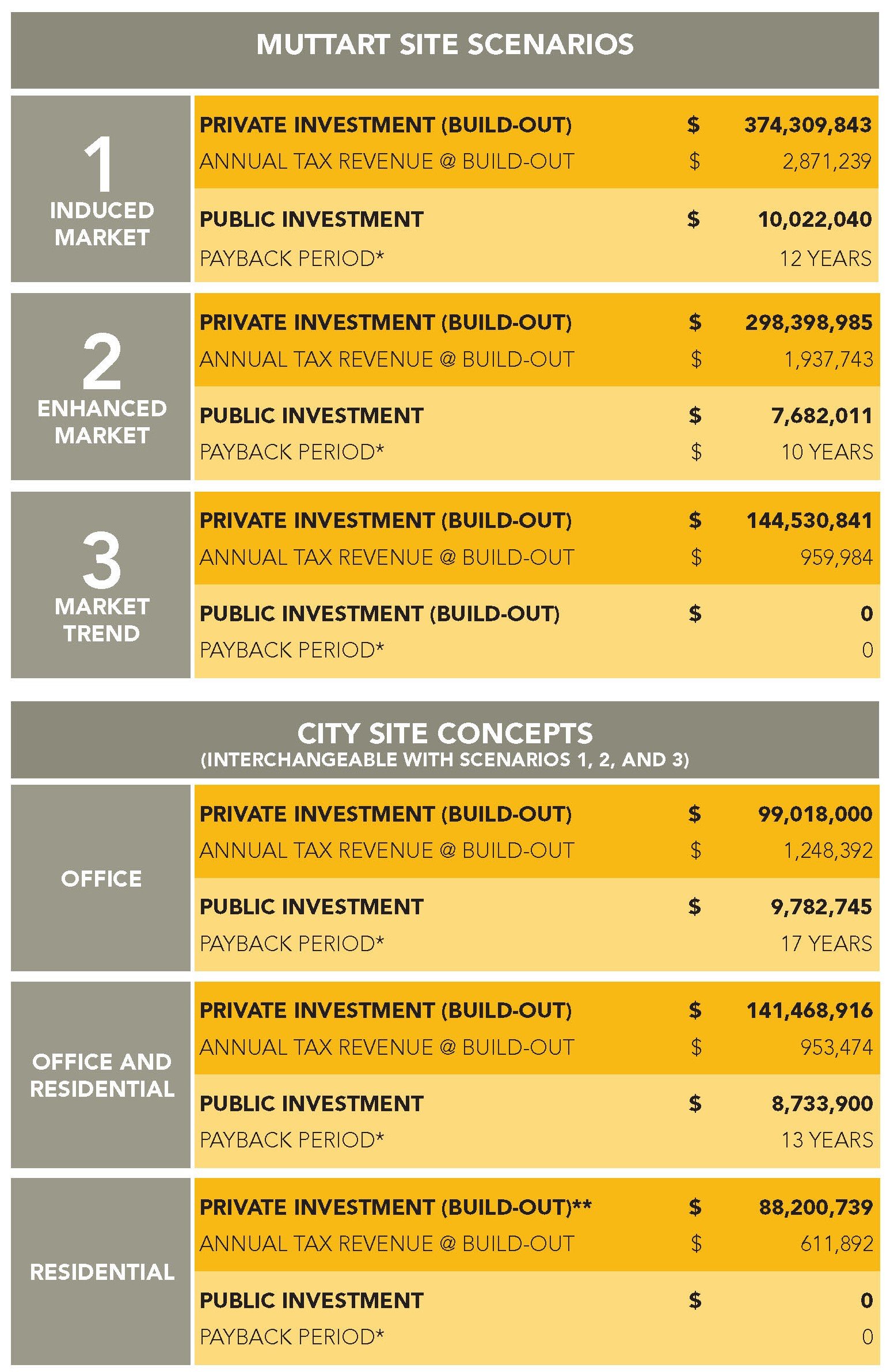

EDMONTON STADIUM STATION TOD BUSINESS CASE FINANCIAL ANALYSIS

Through this business case analysis, we assess different development scenarios that assess levels of public investment and payback to determine financial risk. These typically include a:

‘Business-as-Usual ‘ market trend assessment that includes no public investment.

‘Enhanced’ market assessment that includes some investment in public infrastructure and amenities.

‘Induced’ market assessment that includes public infrastructure and amenities, gap financing, reduction in development fees, contribution of city-owned property, or other means.

We have found that it always takes public investment to ‘prime the pump’ to attract private sector development.

Crandall Arambula utilizes a ‘business case’ assessment to demonstrate the public benefit. Crandall Arambula systematically assesses priority projects to determine which projects have the ability to leverage significant private sector investment, catalyze additional nearby private sector development, and are easier to implement. As part of this process, we will provide a simplified cost/benefit analysis that assesses the potential tax benefit to the city from the new development compared to the infrastructure costs required to support the improvement.

Downtown Bismarck Build-Out Summary

Downtown Bismarck investment ratios

Downtown bismarck ‘Christmas tree’ Financing

Downtown bismarck Game-Changing project phasing

Development Summary

Private Parcel: calculation of building area and parking area.

Public Right-of-Way and Sites: street improvements and amenity (parks, plazas, etc.) areas

Value of private development. Summary of associated private-sector development market value and determination of absorption forecast.

Cost of public investment. Estimated unit cost based upon concept level 10%-30% design.

Financial Analysis

Anticipated annual revenues that will result from private sector investment. Determination of the minimum Return On Investment (ROI) required to financially justify the public expenditure.

Payback period expected for public investment costs.

Financing Strategies

Based on the selection of catalyst projects and the business case analysis, Crandall Arambula can assist the client in identifying the most effective financing tools. Typically, a single source is not adequate and a ‘Christmas tree’ of sources is required, including finances derived from:

General Fund

Capital Improvement Plans

System Development Fees

Tax Increment Financing (TIF) Districts

Regional, State, and Federal Grant Sources

Phasing

Strategy to phase investments by the city, possible ways to encourage developer contributions, and/or other strategies to minimize risk for the client.

Identification of ‘time-sensitive projects’ that may be necessary to prioritize, finance, and build to initiate change.